The Municipal Corporation of Risali is formed on 26 November 2019. Risali Municipal Corporation is located in Shyam Nagar Krishna Talkies Road Risali There is a total of 40 wards. Every Property owner who owns a residential or commercial property or any vacant land is responsible for paying property taxes to government entities like Municipal Corporation or panchayat. The Property tax is required to be paid annually or semi-annually. The location of the property, current valuation, and local laws play a role in determining the property tax amount. Below check more about the process for Risali Nagar Nigam Property-House Tax Online Payment on the official site @cgsuda.com along with other details i.e. Receipt Download, due date, etc.

How to Pay Risali MC Property-House Tax Online?

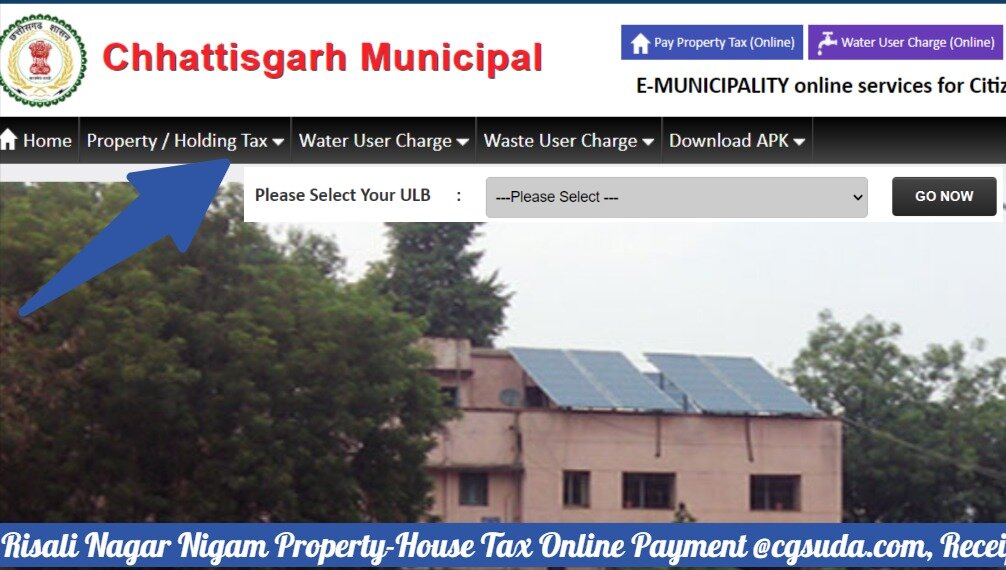

Since Chhattisgarh Municipal Corporation is the authorized governing body you have to visit the CG SUDA website to pay the property-house tax in Risali Municipal Corporation:-

- Navigate to the official web portal of CG Municipal Corporation by clicking the website link here => https://www.cgsuda.com/sudacg/citizen/

- On the web homepage, click on the “Pay Property Tax Online” button.

- Next Page Select ULB as Risali Municipal Corporation.

- Next, select ward, Enter Property ID, Application number, and owner number, and click on the Search button.

- On the next page, you will be able to see your Property details.

- Select the mode of payment if you wish to make the payment with a debit or credit card and Complete the Payment Process.

Eligibility Criteria for Risali Nagar Nigam Property Tax

- Any person whose Age is above 18.

- Who resides Permanently in the city of Risali.

- Any person who owns Property in Risali.

There are certain Property Tax Exemptions for example:-

- Land or Property owned by the State government.

- Any property that is utilized for public worship

- Land Used for Education Purposes.

- Land used for Public Libraries, Museums, and Parks.

Steps to Download Risali MC Property Tax Payment Receipt

- Go to the same official website of Chhattisgarh Municipal at www.cgsuda.com/sudacg.

- Here click on the View Payment details button on the homepage.

- Next Page Select ULB as Risali Municipal Corporation.

- On the next page select ward, Enter Property ID, Application number, and owner number, and click on the Search button.

- You will then be able to see Your Property Tax Payment Receipt.

- Select the date, month, and year for which you want to download the Payment Receipt and take a print copy of the same.

What is Self Assessment Tax and How to Calculate the Tax Online?

Self Assessment Tax can be defined as one way of collecting tax which comprises the balance amount or tax due that an assessee is liable to pay due to the increase in the tax burden during the previous year. It can also be defined as the amount the taxpayer pays where the liability is more than the Actual amount of tax deducted at source, advance tax. The self-assessment of property is also very important to pay taxes in full to make the return filing process successful and valid.

- Open the official web portal at https://www.cgsuda.com/sudacg/citizen/.

- On the home page click on the New Assessment button icon.

- Next, Select ULB as Risali Municipal Corporation.

- Enter your Mobile Number and you will receive an OTP verification for the same.

- Enter the same and proceed with the self-assessment of Property tax.

Conclusion:

If you wish to visit the Municipal Corporation office you can make the property payment through offline method through DD/ Cheque or Cash please find the address below:

- 587w+3GR, Risali Sector, Bhilai, Chhattisgarh – 490006,

- Email Id: [email protected]

- Phone number: 0788-4049469

- Pin code: 490006

You need to carry a few documents and need to share a few information like:-

- Aadhar Card.

- Challan/Property id.

- Old Property identification.

- Property address.

- Phone number

- Email address.